How does GST affect Web Design Services

3 min read

Good and Services Tax

Over the last couple of years, GST has garnered a lot of attention across various segments of industries. Experts and individuals have discussed the merits and demerits of this new tax structure at lengths and breadths. Let us first understand what GST is.

Goods and Services Tax (GST) is an indirect tax which has replaced several other indirect taxes. GST is a destination-based, transaction-value wise reporting structure. It aims to bring multiple tax levies under the ambit of the GST statute so that all of India follows a unified tax structure.

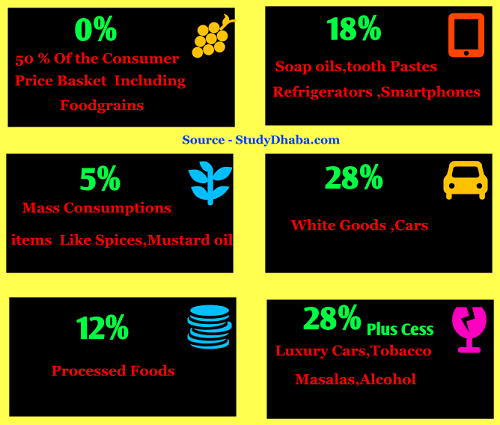

At present over 1300 products and 500 services have been brought under the scope of GST across four tax slabs – 5%, 12%, 18% and 28%.

Services are defined as anything other than goods, money and securities. They include activities that convert money from one form, currency or denomination to another for which a separate consideration is charged.

Website designing has been recognised as one of the services for GST consideration.

GST on Web Designing Services

Services are assigned a Service Accounting Code (SAC) for GST invoicing. Website and Software design and development fall under the SAC 99831, which includes management consulting and management services or information technology services.

- The GST rate on software or web design and development, including software products, services downloads, IP transfers, etc. are fixed at 18%.

- Freelancers offering web designing services used to be taxed at 15% earlier. Under GST, this has been revised to 18%

- Any web design agencies with a turnover of less than 20 lakhs in a year are not required to register for GST. However, if the organisation serves outside the state or wishes to take advantage of input tax credits, then a GST registration is necessary.

- Export of IT services has been exempted from GST and input taxes are eligible to be refunded. Typically, IT/ITES services such as software consultancy, BPO operations come under this category.

Effect of GST on Web Designing Services

The biggest hurdle that IT and web design/development organisations faced on account of GST was to change their IT systems to handle the new tax regime. Many organisations had to redesign their ERP software to account for changes in the tax rules.

The most significant impact of GST on web design services is the provision to apply for input tax credits (ITC). ITC is seen as a major game-changer in GST implementation across industries. To know more, Click here https://www.business-standard.com/article/news-cm/gst-council-announces-reduced-rates-on-various-services-119092100254_1.html. This enables IT service providers, an option of adjusting the input taxes against the service provided by them.

For example, a web designing services organization can adjust the taxes paid on office supplies against web design services provided by them. These organisations incur significant costs in procuring expensive hardware such as servers and on repair and maintenance of such devices. The taxes paid on these can be adjusted against tax paid on the services provided by them.

GST implementation has been a huge challenge for many organisations across industries. Despite these challenges, there are some positive outcomes as well, which is why it is deemed as one of the most significant reforms in recent times.